U.s. Monetary Policy Is Best Described as:

Monetary policy is best described as. Identify which item is not one of the six parts of the financial system.

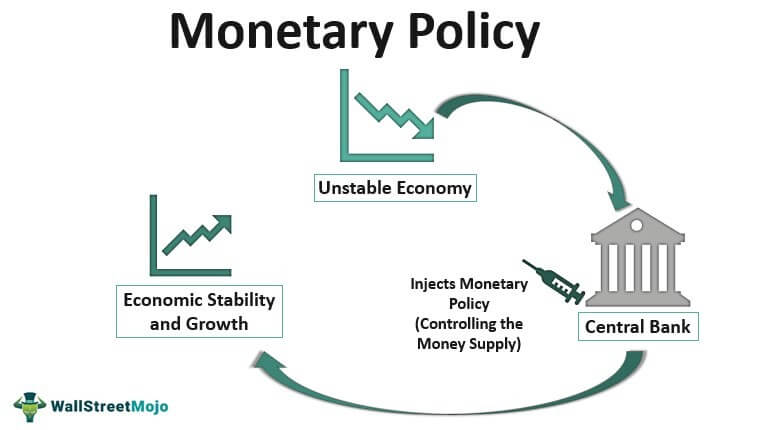

Monetary Policy Objectives Tools And Types Of Monetary Policies

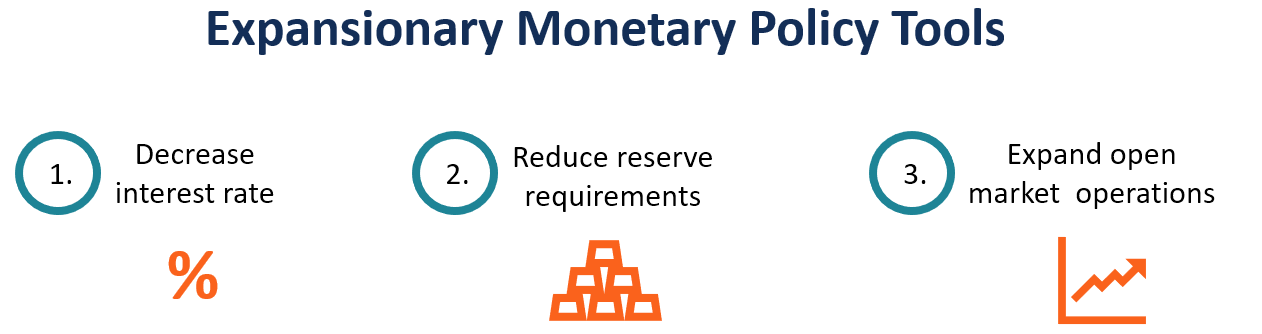

The expansionary monetary policy is designed to.

. Fiscal Policy is the means by which the government keeps the economy stable through taxes and expenditures. Financial instruments can transfer resources and risk between people. Monetary policy is best described as.

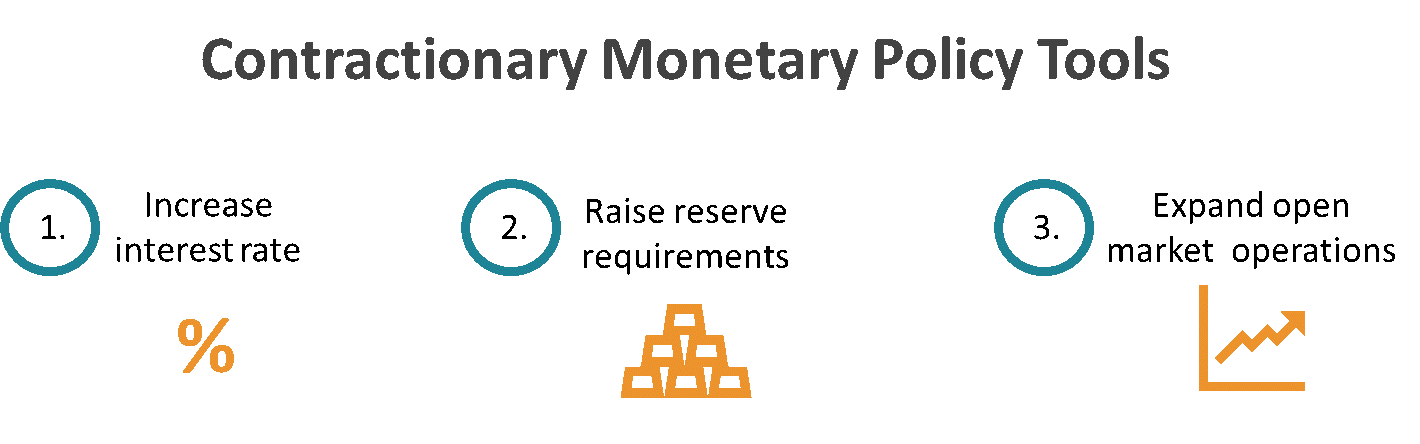

Classify the actions described as examples of expansionary monetary policy intended to stimulate the economy contractionary or restrictive monetary policy meant to slow down the economy or not an example of monetary policy. An informal statement of companys future plans usually expressed in monetary terms. Which of the following statements best describes financial instruments.

The most crucial component of a companys evaluation process. Monetary policies are actions taken to affect the economy of a country. B aimed at keeping inflation low and stable and growth high and stable.

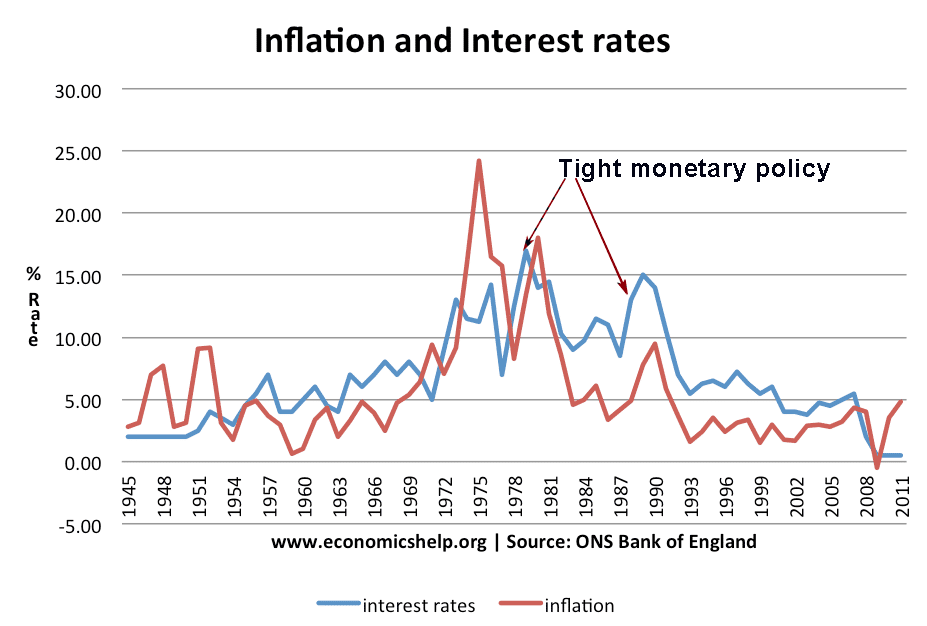

Little evidence suggests the booming market played a large independent role in monetary policy. Monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy. Inflation Inflation is an economic concept that refers to increases in the price level of goods over a set period of time.

The key steps used by a central bank to expand the economy include. The Federal Reserve wants to increase the money supply in the USA. Determining the denominations of a countrys currency.

C one of the most important functions of Congress. The COVID19 recession that started in March 2020 led to an unprecedented decline in economic activity across the globe. Monetary policy is best described as.

To fight this recession policy makers in central banks engaged in expansionary monetary policy. Review of Monetary Policy Strategy Tools and Communications. One of the most important functions of Congress.

The terms refer to different viewpoints on the way monetary policy should influence the. Monetary policy is best described as A keeping inflation low and stable and growth high and stable. In early 2019 the Federal Open Market Committee FOMC or the Committee launched a comprehensive review of its monetary policy framework MPFthe strategies tools and communication practices employed by the Federal Reserve to achieve its congressionally mandated goals of maximum employment and price stability.

Federal Reserve is widely expected to accelerate monetary tightening to tame inflation this year while the Peoples Bank of China needs to use monetary policy tools to stabilise growth. Aimed at keeping inflation low and stable and growth high and stable. Monetary Policy in the 1990s.

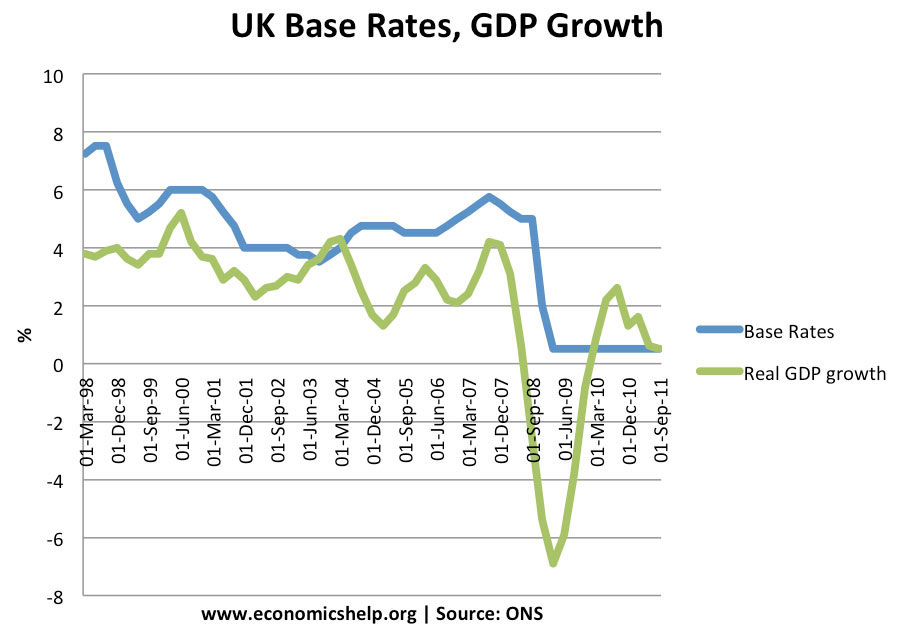

- The President signs legislation that extends the duration of unemployment benefits for people that are out of work. Monetary policymakers are often described as being either hawkish or dovish. The changes in monetary policy are best described as the result of an evolutionary learning process in which the Federal Reserve--from the day it began operations in 1914 to today--has searched for a good procedure for adjusting the instruments of policy.

The central bank information effect can best be described as the ability of central banks to affect market expectations and behavior in addition to monetary policy by disclosing privately held information regarding the future economic outlook Ca Zorzi et al 2020. What is the Federal Reserve likely to do to accomplish. 10 The goal of US.

Monetary Policy is the use of interest rates by the FED to keep the economy stable. Fed policy of the 1990s might well be described as one mans covert inflation targeting and otherwise keeping all options. B determining the denominations of a countrys currency.

D attempting to keep inflation constant at 0 percent. This paper asks whether the measures adopted by the US Federal Reserve Fed have been effective in boosting real. Lower the interest rate increase private investment increase aggregate demand and increase unemployment.

Monetary policy is BEST described as. By managing the money supply a central bank aims to influence. Monetary policy in the United States comprises the Federal Reserves actions and communications to promote maximum employment stable prices and moderate long-term interest rates--the economic goals the Congress has instructed the Federal Reserve to pursue.

It is a powerful tool to regulate macroeconomic variables such as inflation. Reduce the discount rate. The Federal Reserve changing the Reserve Requirement is an example of.

A determining the denominations of a countrys currency. Federal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months actions that will make borrowing sharply more expensive. Aimed at keeping inflation low and stable and growth high and stable.

Monetary policy is the control of the quantity of money available in an economy and the channels by which new money is supplied. Decreasing the discount rate. Making the 1990s essentially the best time ever to be investing in Wall Street.

What is the name of the central bank of the USA.

Chairman Powell Hopes For The Best But Plans For Another V Shaped Lost Half Decade Of A W Shaped Lost Decade Adam Whitehead Lost Decade How To Plan V Shape

Monetary Policy An Overview Sciencedirect Topics

Tight Monetary Policy Economics Help

Quantitative Easing Not As We Know It Government Corporation Advanced Economy Low Interest Rate

We Are Entering Into A New Era Of Inflation Are You Prepared Financial Asset New Era Commodity Prices

Monetary Policy An Overview Sciencedirect Topics

What The Gbpusd Will Look Like After Tomorrow S Boe Meeting Us Dollar Index Gbp Usd Monetary Policy

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Expansionary Monetary Policy Definition Tools And Effects

Contractionary Monetary Policy Definition Tools And Effects

Monetary Policy Definition Types Examples Tools

Monetary Policy Definition Types Examples Tools

Monetary Policy Vs Fiscal Policy Economics Help

Bitcoin Is About To Make A Move Towards 10k Analyst Explains Why What Is Marketing Bitcoin Explain Why

Inflationary Inflection Point Or Temporary Blip Inflection Point Financial Markets Stock Market

Impacts Of Federal Reserve Policies Boundless Economics

New Zealand Dollar On Track Supportive New Zealand Dollar Gold Price

The Data In The Chart Is Described In The Text Economic Trends Investing Economic Activity

Comments

Post a Comment